NOT planning on claiming home office deductions. Office supplies for home office (paper/pens, printer, misc computer peripherals). Incidentals - ie: Groceries (soda, TP, snacks) on days I traveled

Roundtrip Mileage at $0.58/mile for Airport travel Are there any concerns with claiming (deducting) any of the following against my Contractor Pay, Per Diam, and Expense Reimbursement?Īirport Parking at $135 (I chose a more expensive option) I traveled 3 out of 4 weeks in March and I am not sure how much I will travel in the future. My questions really relate to qualified expenses. New Job - $9200 wages, $600 Per Diam (10 days travel), $100 airport parking, $100 mileage to/from airport Substitute Teaching $1300 - Medicare (1.45%) withheld, no SSI withheld (pension)

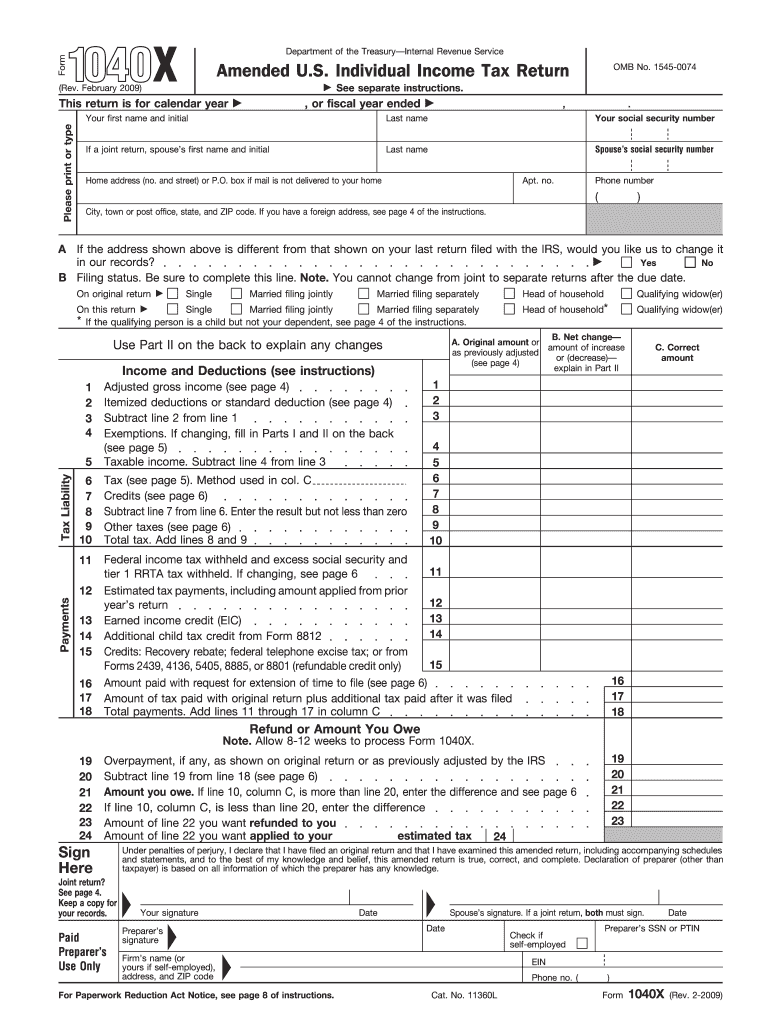

Unemployment $7000 - Fed and State tax withheld My 2019 pay so far (round numbers) has been: I inquired with a few CPAs and due to tax season and my new work schedule/travel no one can see me before April 15 when my estimated taxes will be due. I expect my 2019 tax burden to be similar to my 2018 burden. I am on contract in March and April and hope to become a W-2 employee in May. I have been a W-2 employee for all of my life (25+ years.) I was laid off in August and started a new position (Yeah Me!) as a contractor in March. I have read thru the Wiki and Schedule C, C-EX, SE, and Publication 535 and still have questions related to 2019 Estimated taxed and expenses.īackground: My spouse is a W-2 employee withheld at 0 exemption level and will make similar to last year's salary.

0 kommentar(er)

0 kommentar(er)